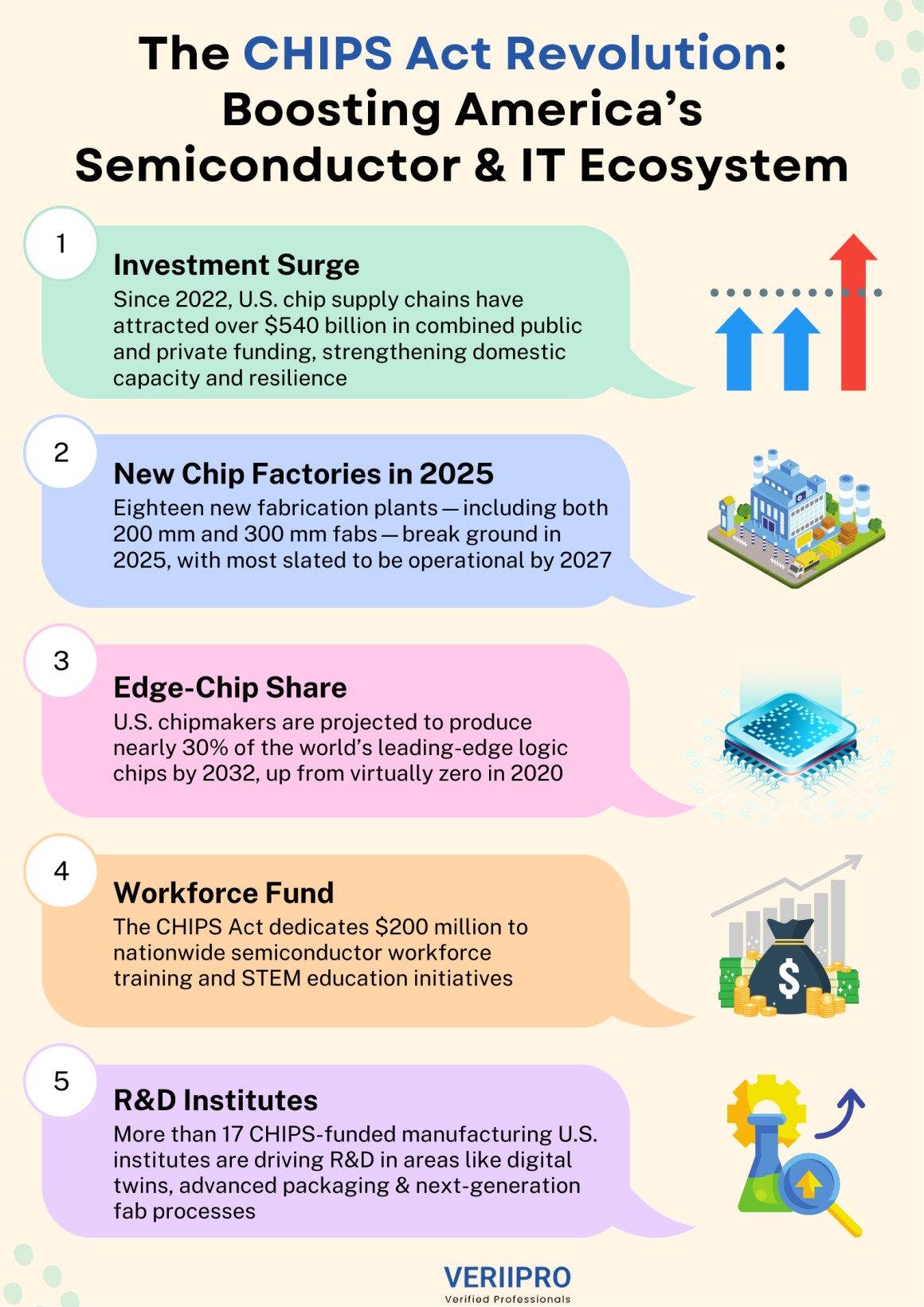

The CHIPS Act Revolution: Boosting America’s Semiconductor & IT Ecosystem

The CHIPS and Science Act of 2022—often called a seminal legislation—provides $52.7 billion in incentives to revitalize U.S. semiconductor manufacturing and support critical IT research Reuters. Since enactment, over $450 billion in private investments have been announced across 28 states Semiconductors. The legislation also underwrites $200 million in workforce training programs and bolsters research hubs, including a new $285 million Manufacturing USA Institute in North Carolina NSF – National Science Foundation U.S. Department of Commerce. As fabs rise in Arizona and Texas—while safeguards prevent expansion in adversarial nations—the Act is positioning America to reclaim leadership in chipmaking and the broader IT ecosystem.

The Genesis of the CHIPS Act

Congress passed the CHIPS and Science Act in August 2022, allocating $50 billion in direct subsidies and $2.7 billion through National Science Foundation programs Congress.gov. Its goal was to reverse decades of offshore fabrication, which had reduced U.S. share in global chip production to under 10% by 2022 Semiconductors. Legislators framed the Act as essential for economic competitiveness, supply-chain resilience, and the creation of high-wage manufacturing jobs stateside AP News.

Safeguarding National Security

To mitigate geopolitical risks, recipients of CHIPS funds are barred from expanding advanced facilities in China or other countries deemed national-security threats under U.S. law Reuters. This restriction ensures that taxpayer-backed technology remains under domestic control and limits adversarial access to critical microelectronics Reuters.

Surging Investment and Job Creation

Federal allocations have unlocked a flood of private capital—nearly $450 billion announced since 2022 across more than 90 projects in 28 states Semiconductors. The Commerce Department has approved $32.54 billion in grants and $5.85 billion in loans to 32 companies Semiconductors. Industry forecasts estimate over 68,000 direct manufacturing roles, 122,000 construction positions, and more than 500,000 total jobs supported throughout the economy AP News.

Flagship Corporate Initiatives

- TSMC’s Arizona fab is on track for mass production of 4 nm chips in early 2025, backed by $6.6 billion in CHIPS funding and plans for a $100 billion total U.S. investment TSMC.

- Samsung’s Texas campus received up to $4.745 billion in incentives for two new fabs and an R&D center, creating thousands of construction and permanent jobs U.S. Department of Commerce.

- GlobalFoundries leadership notes that CHIPS subsidies and tax credits are enhancing U.S. competitiveness, and forthcoming tariffs may further boost demand for domestically produced chips Reuters.

Strengthening the IT Ecosystem

Semiconductors underpin modern IT—from cloud data centers to edge-computing devices. The Department of Commerce is negotiating up to $300 million in advanced packaging research across Georgia, California, and Arizona to accelerate heterogeneous integration for AI accelerators and 5G infrastructure U.S. Department of Commerce. Meanwhile, the new $285 million Manufacturing USA Institute in Durham, NC, will simulate and optimize next-generation fab processes U.S. Department of Commerce.

Research Partnerships & Workforce Development

NSF-backed initiatives under the Act fund university consortia to train technicians and engineers, addressing the semiconductor talent gap NSF – National Science Foundation. Industry alliances have launched 16 new fabrication centers with specialized degree programs in collaboration with U.S. universities Semiconductors.

Challenges and Critiques

Some critics label the CHIPS Act as corporate welfare, warning that subsidies might favor established players without driving true competition or resilience AP News. Others caution that reshoring alone cannot eliminate supply-chain shocks, advocating for complementary measures like strategic stockpiling and streamlined regulations BCG Global. Nonetheless, most stakeholders agree that without these incentives, regaining U.S. leadership would be far more challenging TSMC.

Looking Ahead

Consulting firms project U.S. market share growth to 14% of global manufacturing capacity and 28% of advanced logic output by 2033, up from 10% in 2022 Semiconductors BCG Global. As new fabs come online and R&D initiatives mature, downstream sectors—automotive electronics, AI hardware, and quantum computing—stand to benefit. By coupling sustained federal support with private-sector innovation, the CHIPS Act is laying the groundwork for a renewed American semiconductor and IT ecosystem.

Looking for opportunities in semiconductor innovation? VeriiPro is here to help!